As most of Canberra prepares for a day-off on the Australia Day public holiday, over 50,000 people will be working on Thursday across the ACT.

Employers are reminded of their obligations to correctly pay staff rostered on to work during the public holiday. It is unlawful to underpay employees, and it is the responsibility of the employer to know the correct rate of pay.

The May 2016 Fair Work Ombudsman audit of Canberra businesses found that 43 percent of businesses were not compliant with their legal requirements. Underpayments were the most common error. There is also increasing reports of employers in the hospitality and clubs sector using bundled ‘salary’ arrangements to avoid paying penalty rates.

The following quotes are attributable to Alex White, secretary of UnionsACT:

“The tens of thousands of Canberrans who will work on this Thursday’s public holiday are sacrificing time with friends and family.

“Penalty rates have existed as a vital part of Australia’s society and culture for almost a century to compensate workers for the effects of working unsociable hours.

“There is no excuse for underpaying your staff. Employers need to inform themselves of the minimum rates for public holidays.

“Most businesses do the right thing and pay their staff correctly, which is why it is unacceptable for the few dodgy bosses who deliberately underpay to get away with breaking the law.

“Young people, people from non-English speaking backgrounds, and temporary migrants are particularly at risk of being underpaid.

“If you believe you are not being paid the correct rate, contact your union or the Fair Work Ombudsman.”

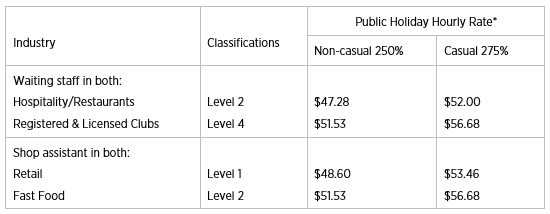

* Note: The pay rates are hourly rates of pay for the specified classification and are full adult rates of pay. Employers and employees can check the rates of pay at the Fair Work Ombudsman website.